For professional investors only

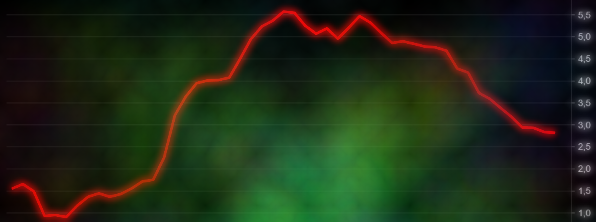

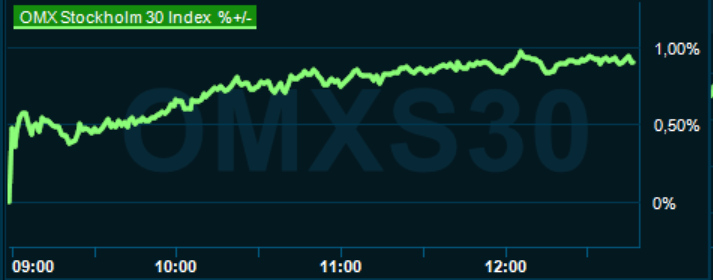

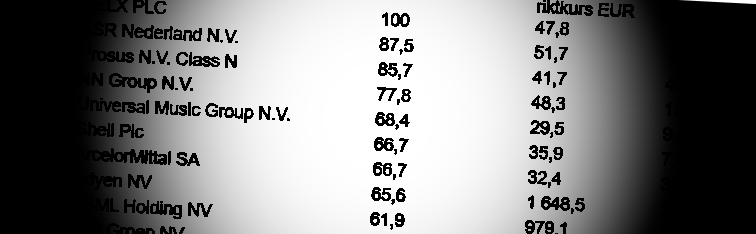

Fixed income ETFs have captured 52% of all flows into the European ETF market so far this year (1). One key driver of growth is the increasing adoption of ETFs among investors, who are starting to embrace the simplicity of the ETF structure. Record low interest rates and bond yields are also pushing investors to focus on how fees cut into potential returns, shifting demand to low cost ETF solutions.

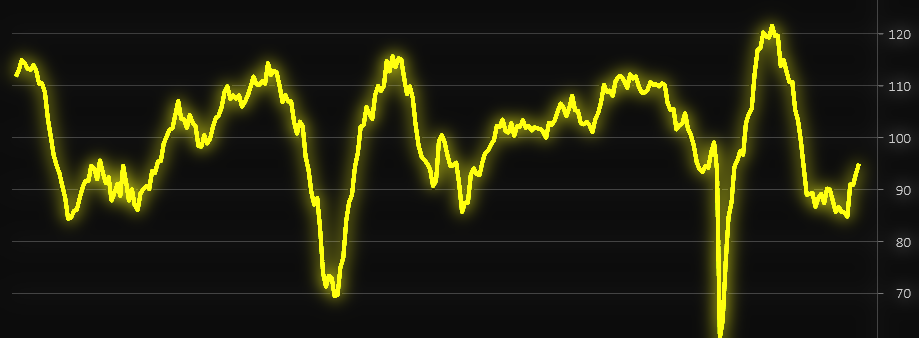

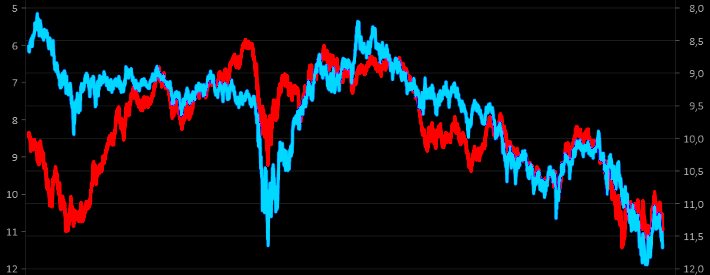

The ETF structure was validated during the height of the crisis in March. ETFs continued to trade when underlying bond markets seized up, and ETF investors benefited from multiple sources of liquidity. Fixed income ETFs proved to be resilient during the COVID-19 crisis and became a useful price discovery vehicle for the bond market.

Fixed income ETFs offer investors low cost, transparent, and efficient access to all types of bonds, and have passed the ultimate liquidity test.

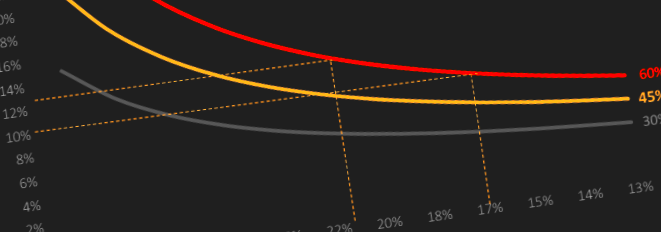

See where ETFs make sense in fixed income

Investment risks

Investment strategies involve numerous risks. Investors should note that the price of your investment may go down as well as up. As a result you may not get back the amount of capital you invest.

Important information

This document contains information that is for discussion purposes only, and is intended only for professional investors in Sweden. Marketing materials may only be distributed in other jurisdictions in compliance with private placement rules and local regulations.

Data as at 14/10/2020 unless otherwise stated.

By accepting this document, you consent to communicating with us in English, unless you inform us otherwise.

This document has been communicated by Invesco Investment Management Limited, Central Quay, Riverside IV, Sir John Rogerson’s Quay, Dublin 2, Ireland.

EMEA8141/2020

(1) Source: Bloomberg, Invesco, 31 Aug 2020

.png)